Instalments for Everyone

Don't wait for your paycheck and start shopping now!

- Quick and easy process

- Applies to the entire range of products with a minimum purchase amount of HUF 50 000

- Splitting your payment by month won't burden your budget

- Smart investment when buying multiple items

How do I buy goods in instalments?

- Fill out the application online in the comfort of your home

- I will arrange everything in person at the store

-

On the product page, click on the Buy in Instalments button. Choose how many monthly instalments you want to pay. Proceed as you would with a normal purchase.

-

Fill in your personal details on the instalment form; the bank will then assess your application.

-

Once the bank approves your application, print the application and deliver it signed it to the bank.

-

Bank will infrom us once the documents received. The delivery process starts.Enjoy.

General Credit Terms & Conditions

- Full legal capacity, at least 18 years of age

- A valid permanent address in Hungary. Direct contact via landline at the residential address or a prepaid mobile phone number, or in case of employees, direct contact via telephone at work or place of work

- Proven regular income

- Not being on probation or notice in the active employment

- The minimum purchase price is HUF 50,000

- I have secured all the required documents

Required Documents

- A valid permanent identity card issued by a Hungarian authority; or a valid personal identity card and residence card; a new, card format driving license and residence card, or a valid passport and residence card

- Income verification documents vary based on: if you are an employee; a sole proprietor or a company owner; a licensed traditional small-scale producer, or a pensioner. More detailed information is shown below.

- (The documents must be fully photocopied and all details must be legible. No other documents can be accepted apart from the above)

-

Choose the product that suits you best. Then, with the help of our colleague, you can calculate the repayment period and the amount you need to repay.

-

Please bring your personal documents and proof of income with you to our shop. For more information, see below.

-

Our colleague will prepare your loan request, which will be assessed by the bank shortly on the basis of the documents presented and your contract will be drawn up.

-

Once the contract is signed, all you have to do is take delivery of your new item.

General Credit Terms & Conditions

- Full legal capacity, at least 18 years of age

- A valid permanent address in Hungary. Direct contact via landline at the residential address or a prepaid mobile phone number, or in case of employees, direct contact via telephone at work or place of work

- Proven regular income

- Not being on probation or notice in the active employment

- The minimum purchase price is HUF 50,000

- I have secured all the required documents

Required Documents

- A valid permanent identity card issued by a Hungarian authority; or a valid personal identity card and residence card; a new, card format driving license and residence card, or a valid passport and residence card

- Income verification documents vary based on: if you are an employee; a sole proprietor or a company owner; a licensed traditional small-scale producer, or a pensioner. More detailed information is shown below.

- Please bring the documents in their entirety in their original form, no documents other than the above will be accepted.

What can I buy in instalments?

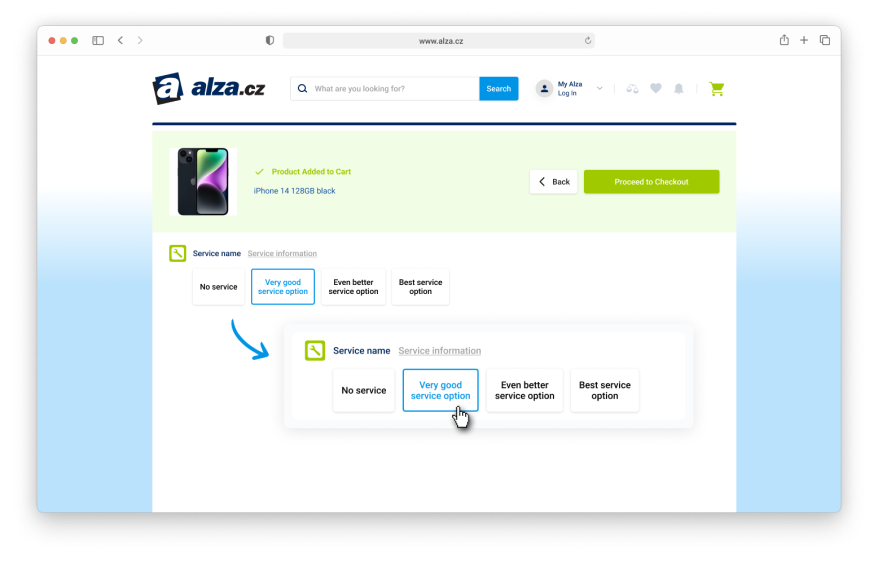

How do I choose to pay in instalments?

Choose Your Instalment Plan

|

|

Lowest Payments |

Top

Good Balance |

Fastest Repayment |

|

|---|---|---|---|---|

| Price |

HUF 100,000

|

HUF 100,000

|

HUF 100,000

|

HUF 100,000

|

|

Down payment

|

HUF 0

|

HUF 0

|

HUF 0

|

HUF 0

|

|

Number of monthly instalments

|

36

|

18

|

10

|

20

|

|

Monthly instalment payment

|

HUF 3,629

|

HUF 6,597

|

HUF 11,598

|

HUF 5,000

|

|

|

HUF 100,000

|

HUF 100,000

|

HUF 100,000

|

HUF 100,000

|

|

Total amount payable by client

|

HUF 130,644

|

HUF 118,746

|

HUF 115,980

|

HUF 100,000

|

|

Annual interest rate

|

18.29 %

|

22.50 %

|

33.50 %

|

0 %

|

|

Annual percentage rate

|

19.90 %

|

24.97 %

|

33.50 %

|

0 %

|

|

|

CREDIT REFERENCE APR:19.90%, for a credit amount of HUF 2 000 000 and a term of 36 months.

The reference APR is determined by taking into account the indicated credit amount and duration available for the type of credit, in derogation of Section 9 (1) of Government Decree 83/2010 (lll.25.) on the determination, calculation and publication of the total lending rate. Duration: 10, 12, 15, 18, 20, 24, 30 or 36 months. Amount of credit available: from HUF 50 000 to HUF 2 000 000. Counterpart, not compulsory, but may vary according to the choice of the client and/or the result of the credit assessment.

Alza.hu Kft. is the credit intermediary of Magyar Cetelem Zrt. (Bank), the Bank reserves the right to determine the documents required for the credit assessment, to the credit assessment and excludes the obligation to make an offer. For further details, see the General Terms and Conditions and the relevant notices. https://www.cetelem.hu/segedlet/dokumentumok (Only available in Hungarian language)

Valid from the 2th of January 2024 until revoked.

Documents to download (Only available in Hungarian language)

- Announcement APR 19.90% II. shops

- Announcement APR 19.90% II. web shop

- Employment certificate

- Agent information

- Presentation of the effects of income change

Links (Only available in Hungarian language)

- Information on the risks of excessive indebtedness: https://www.mnb.hu/letoltes/tajekoztato-a-tulzott-eladosodottsag-kockazatairol.pdf

- Cetelem documents: https://www.cetelem.hu/segedlet/dokumentumok

Other FAQ about instalment purchases

Additional information on conditions and documents

-

Credit applications to Cetelem may be submitted by anyone who meets the following requirements:

- Natural person.

- Age over 18 years old.

- Permanent address in Hungary.

- Income certificate of a regular income.

- Available directly by landline phone at the address of residence or by prepaid mobile phone.

- For employees: available directly by telephone at place of work or place of employment.

- Our company charges the client a fee for the following other services which do not qualify as financial intermediation: delivery and warranty fees.

- The person is an active employee, not being on probation period or on notice period.

Essential documents to check the data that are necessary for a credit assessment:

-

1. Documents – proof of identity and address

- A valid permanent proof of identity, or identity card and a residential address card issued by the Hungarian authority, a new type, card format driving licence and a residential address card issued by the Hungarian authority, or

- a valid passport and a residential address card issued by the Hungarian authority 2. Documents to prove income

- If you are an employee: employer’s Certificate not older than 30 days, showing that you have been employed for at least three months with an indefinite contract, or with a fixed-term contract that lasts at least until the duration of the loan (the form of Magyar Cetelem Zrt., or other Employer’s Certificate that contains the details and information of the Magyar Cetelem Zrt. form),or

- The last three bank statements of the bank account that the applicant has held for at least three months while employed by the same employer – the statement is issued in a manner that it can be defined both in terms of title and amount that the income is from the employment with the same employer for at least three months, it also has to contain the applicant’s name and address used on the credit application form, and/or the joint debtor’s name and address used on the credit application form. As per the pension slip, the bank statement of the last month is required. The last three bank statements of the bank account that the applicant has held for at least three months while employed by the same employer – the statement is issued in a manner that it can be defined both in terms of title and amount that the income is from the employment with the same employer for at least three months, it also has to contain the applicant’s name and address used on the credit application form, and/or the joint debtor’s name and address used on the credit application form. As per the pension slip, the bank statement of the last month is required.

- If you are self-employed or own a business - Entrepreneurs - owner of a company, its non-employed executive, self-employed person and employees of a family business - proof of income necessary from the tax authorities.

- If you are a licensed traditional small-scale producer: for licensed traditional small-scale producers: proof of income necessary from the tax authorities.

- If you are retired: your last pension slip or a statement of your bank account (regular bank account) not more than two months old, which shows the applicant’s pension in a manner that can be defined both in terms of title and amount, and the pension record is issued to the customer or to the customer together with the customer's spouse, or a pension slip from the beginning of the year showing the yearly amount of the pension.

- In the case of personal independence payment or rehabilitation allowance, the resolution of the payment or allowance, the awarded payment/allowance should last at least until the end of the loan term. In addition to the documents listed above, the Bank may request the submission of additional documents. In the case of other income supporting benefits, the Bank will decide on creditworthiness on an individual basis. In the case of a credit plan without an employer's certificate, the owner of a business/company, a non-employed executive, a self-employed person and employees of a family business are not eligible to apply for a loan. PRESENTATION OF THE EFFECTS OF INCOME CHANGE.

Agent information

-

Company name: Alza.hu Kft, Registered address:Róbert Károly körút 54-58, 1134- Budapest, Hungary, Mailing address:

supervisory authority: Magyar Nemzeti Bank (central mailing address: 1850 Budapest, Hungary Central telephone no.: (+36-1) 428-2600, central fax no.: (+36-1) 429-8000, Email [email protected] - Our company is present in the registry of intermediaries handled by Magyar Nemzeti Bank. The registry can be checked through the above contacts or on the website www.mnb.hu.

- Our company, as a dependent intermediary, acts on behalf of Magyar Cetelem Zrt, and represents the interests of the principal.

- Our company does not provide personalised recommendations (credit counselling) related to mortgage loans or financial leases related to consumer real estate - separate from the provision of credit and money loans, financial leases and financial intermediary services.

- Our company can accept commission fees for the mediation of financial services exclusively from the principal. Our company receives a commission fee from the financial institution, Magyar Cetelem Zrt.

- Magyar Cetelem Zrt. guarantees that the client may submit a complaint about the conduct, activity or failure of our Company orally (in person, by telephone) or in writing (by a document submitted in person, by post, fax, or email).

- Magyar Cetelem Zrt. will accept verbal complaints during the opening hours at all premises open to its customers, and if not available, at its registered address every working day from 8 am to 4 pm; verbal complaints via telephone every working day and one working day of the week (Monday) from 8 am to 8 pm; written complaints via electronic means, with an alternative contact in case of breakdown. Magyar Cetelem Zrt. will immediately investigate the oral complaint and rectify it if necessary. If the client does not agree with the handling of the complaint, Magyar Cetelem Zrt. shall make a record of the complaint and its related position, and provide a copy of the record for the client in case of a verbal complaint communicated in person; and in case of a verbal complaint submitted via telephone, send a copy of the record to the client. If an immediate investigation of the complaint is not possible, Magyar Cetelem Zrt. shall make a record of the complaint and provide a copy for the client in case of a verbal complaint communicated in person; in case of a verbal complaint submitted via telephone, send a copy of the record to the client; in other situations, it will proceed according to the provisions related to written complaints. Magyar Cetelem Zrt. will send its position on the matter with its associated reasoning in response to the written complaint about the customer, within 30 days of the announcement of the complaint. The out-of-court settlement of disputes related to the establishment and performance of the legal relationship related to the use of the service belongs to the responsibility and competence of the Hungarian Financial Arbitration Committee (Pénzügyi Békéltető Testület). To this end, the Hungarian Financial Arbitration Committee will seek to reach an agreement failing which, it will take a decision on the matter to ensure that consumer rights are enforced easily, quickly, efficiently and cost-effectively.

- Our company charges the client a fee for the following other services which do not qualify as financial intermediation: delivery and warranty fees